In these Covid days, it is very common to see maps comparing the situation in different EU member states.

Here’s another map, but this one is not about Covid.

.

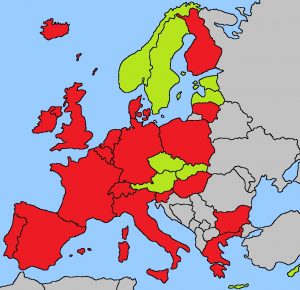

You will notice that much of the map is red. There are just a few countries that are green, including the Czech Republic.

Can you guess the significance of the colours?

The red countries are ones which have Estate or Inheritance taxes. The green countries do not.

What is Inheritance Tax?

The expression inheritance Tax actually covers two different kinds of tax. Technically, inheritance tax is tax paid by a person who inherits money or property from a person who has died. The other variant, estate tax, is a tax on the estate (money and property) of a person who has died before it is distributed. There is a lot of confusion and misuse of these two terms. For example, the tax in the UK is officially called “Inheritance Tax” but it is not an inheritance tax, it is an estate tax.

How Much is it?

The rate of tax varies widely from country to country and also depends on how much money the person has. Some rates are quite low. Others are much higher. Here are some examples of some of the higher rates in the EU:

-

- Spain: 82%

- Belgium: 80%

- France: 60%

- Denmark: 52%

- Germany: 50%

- UK: 40%

So as you can see, these rates can be extremely high.

Why do Governments like Inheritance taxes?

As the map shows, inheritance taxes are very popular with governments. There are a few reasons for this:

-

- Inheritance taxes do not normally apply to poor or middle-income families. They usually apply only to the “rich”

- They are therefore seen as a ‘fair’ tax which helps address inequality in society. Part of the wealth goes to the government, which is used for the benefit of all the citizens.

- They are seen as ‘painless’. They are not paid by anyone during their lifetime and instead just reduce inheritance payments which are already quite large.

- Because they don’t apply to most people, they are a very easy, and painless way for Governments to increase revenue without hurting (most) voters. In fact, introducing inheritance tax is about the only kind of new tax that is popular with most voters

How are Inheritance Taxes Introduced?

When inheritance taxes are introduced, they are almost inevitably done without any advance notice. The reason is that it is important not to give people time to reorganise their affairs (e.g by giving everything to the children) before the new tax takes effect.

They also come with ‘anti-avoidance rules. The most common is a tax on gifts, again to stop people giving things away to children or putting them in trust in order to avoid the new tax.

What is the likelihood of the Czech Republic re-introducing Inheritance Tax?

We do not have a crystal ball or any special sources of information, but we would rate the likelihood of an inheritance tax coming to CZ and now quite high

First, the Czech Republic had inheritance taxes at a relatively low level until 2013.

Second, as we all know, the Covid Pandemic has had an enormous negative impact on Government finances. They now have a big hole that they need to fill.

Inheritance taxes must seem like an incredibly tempting way of doing that.

By the way, you might be thinking that this particular government is not that likely to introduce such a tax, but perhaps it is worth remembering that our current Prime Minister already has much of his wealth in trusts

What can you do to protect yourself?

Internationally, one of the main uses of trusts is to protect families against inheritance taxes. Remember that once your assets are in a trust, they are no longer yours. That means that they do not form part of your inheritance. The very best time to put your assets in a trust is before the new tax comes into force.

It may be that you have already been thinking about setting up a trust for some other reason, for example:

-

- To protect your family from attack

- To solving inheritance problems

- To protect children from others, and sometimes also from themselves

- To pass your business on to the next generation without conflict

- To build a family or business ‘dynasty’ passing your wealth not just to the next, but also to future generations.

It may also be that you have been procrastinating or that you are in some other way “stuck”.

If you are, then we strongly encourage you to get on with it and move forward with your new trust.

Once inheritance tax arrives, it will be too late!