We are all in favour of taking steps to prevent Money Laundering and Terrorism, and we strongly support any sensible steps taken by the State to present the misuse of the financial system for these purposes.

Unfortunately, over recent years, the EU has started to go far beyond what is sensible, imposing a range of measures which in our opinion, have zero impact on criminals, but have a hugely negative effect on innocent individuals and families as they seek to go about their legitimate business.

It is also interesting to keep in mind the protections provided to us all by the GDPR and the European Convention on Human Rights. The Convention says:

Article 8 – Right to respect for private and family life

- Everyone has the right to respect for his private and family life, his home and his correspondence.

- There shall be no interference by a public authority with the exercise of this right except such as is in accordance with the law and is necessary in a democratic society in the interests of national security, public safety or the economic well-being of the country

Despite these basic protections, the EU and the Czech State have imposed a number of rules around the Register of Beneficial Ownership which seem to directly conflict with those important rights. They argued that this interference with our fundamental rights was justified because it was proportionate and necessary.

We support the existence of a UBO register. It is important in preventing abuse of the system. The State, banks, and contractual parties have a logical interest in knowing who is behind companies and who they are really dealing with. Criminals must not be allowed to use companies to mask their criminal activities.

What we strongly disagree with is the extension of this system so that the private details of company shareholders and in some cases also trusts and foundations are exposed to public view, available not just to those with a legitimate interest, but to anyone at all.

Anyone at all includes your nosey next-door neighbours and people with ill intent including gold diggers, blackmailers and scam artists. Thus, the state has been taking steps with the stated objective of preventing crime which have the actual effect of assisting criminals. That’s not proportionate and nor is it necessary.

Thankfully, common sense has finally prevailed!

Last week, the Court of Justice of the European Union (CJEU) decided that the measures in the EU Fifth Anti-Money Laundering Directive (5AMLD) which require EU Member States to give the public unlimited access to their UBO registers are invalid because they breach privacy and data protection rights.

The CJEU said that the measures in 5AMLD go beyond what is necessary and proportionate. Making the register public enables a potentially unlimited number of persons to find out about the material and financial situation of a beneficial owner, and that information can never be recalled from the register. Making the register fully open to the public thus violates individuals’ privacy, it said, concluding that Member States must put appropriate safeguards in place to protect privacy in accordance with articles 7 and 8 of the Charter of Fundamental Rights of the European Union.

As a result of the judgment, Luxembourg and Holland have already suspended public access to their registers

We suppose Czech will follow soon (as the Czech State is now in effect in breach of GDPR!) and we hope that a renewed sense of common sense will apply to future AML measures.

Many ordinary Czech people already know something about trusts, and they are increasingly interested in knowing more. They are interested not just in how trusts can help the wealthy, but also how they can help their own families. We suppose this is the main reason behind the success of our book. Before our book came out there was no easily accessible source of this information.

Many ordinary Czech people already know something about trusts, and they are increasingly interested in knowing more. They are interested not just in how trusts can help the wealthy, but also how they can help their own families. We suppose this is the main reason behind the success of our book. Before our book came out there was no easily accessible source of this information.

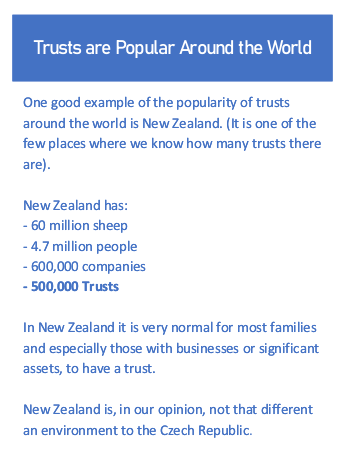

Philip lives in New Zealand As we have mentioned in the past, and as the box to the right illustrates, unlike the Czech Republic, New Zealand is a country of trusts.

Philip lives in New Zealand As we have mentioned in the past, and as the box to the right illustrates, unlike the Czech Republic, New Zealand is a country of trusts.